Offshore accounts built for global living

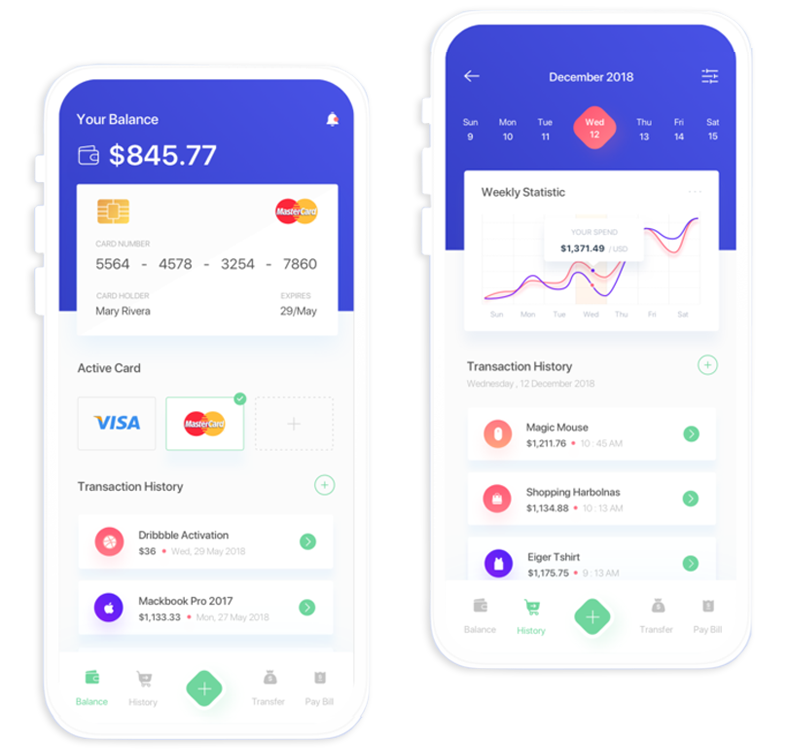

Open a secure offshore account in days — not months

Personal, business, and trust accounts with multi‑currency capability, fast international payments, and bank‑grade security. Fully compliant onboarding with transparent pricing.